mass wage tax calculator

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. It doesnt matter how much you make.

2015 Tax Changes For Massachusetts

Residents must file their 2021 personal income tax returns by Oct.

. The total Social Security and Medicare taxes withheld. Payroll taxes in Massachusetts Massachusetts income tax withholding. That goes for both earned income wages salary commissions and unearned.

The Massachusetts Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and. Massachusetts has a 625 statewide sales tax rate. To use our Massachusetts Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Calculate your Massachusetts net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free. 15 Tax Calculators 15 Tax Calculators. Your average tax rate is 1681 and your marginal tax rate is 24.

So the tax year 2022 will start from July 01 2021 to June 30 2022. Just enter the wages tax withholdings and other information. Contacting the Department of.

If you make 125000 a year living in the region of Massachusetts USA you will be taxed 27039. Massachusetts is a flat tax state that charges a tax rate of 500. Calculating your Massachusetts state income tax is similar to the steps we listed on our Federal paycheck.

On the first 15000 each employee earns Massachusetts employers also pay unemployment insurance of between 094 and 1437. However depending on how much you make in a year. Massachusetts Income Tax Calculator 2021.

17 if they didnt make the initial April 19 deadline. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. In 2022 and possibly in 2023 any taxpayer who generates income in Massachusetts will be charged with a 5 state income tax.

If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667. Overview of Massachusetts Taxes. The Massachusetts Income Tax Calculator Will Let You Calculate Your State Taxes For the Tax Year.

Your average tax rate is 1198 and your. If you paid at least 80 of your tax bill in April you qualified. The amount of federal and Massachusetts income tax withheld for the prior year.

The Federal or IRS Taxes Are Listed. New employers pay 242 and new. Use ADPs Massachusetts Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

As of January 1 2020 everyone pays 5 on personal income. See where that hard-earned money goes - Federal Income Tax Social Security. Massachusetts Hourly Paycheck Calculator.

After a few seconds you will be provided with a full. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and. In this past fiscal year Fiscal Year 2022 FY22 Massachusetts tax revenue collections exceeded the annual tax revenue cap set by Chapter 62F of the Massachusetts General.

Llc Tax Calculator Definitive Small Business Tax Estimator

Tax Withholding For Pensions And Social Security Sensible Money

Kansas State Taxes Ks Income Tax Calculator Community Tax

Massachusetts Paycheck Calculator 2022 With Income Tax Brackets Investomatica

New Tax Law Take Home Pay Calculator For 75 000 Salary

Tax Day The Tax Form 1040 Dollar Orange Black Wallet Bitcoin And Black Smartphone With Calculator Is On A Wooden Table Stock Photo Alamy

Massachusetts Income Tax Calculator 2022 2023

Taxes 2022 What S My Tax Rate Here Are The Income Brackets For 2022 Cbs News

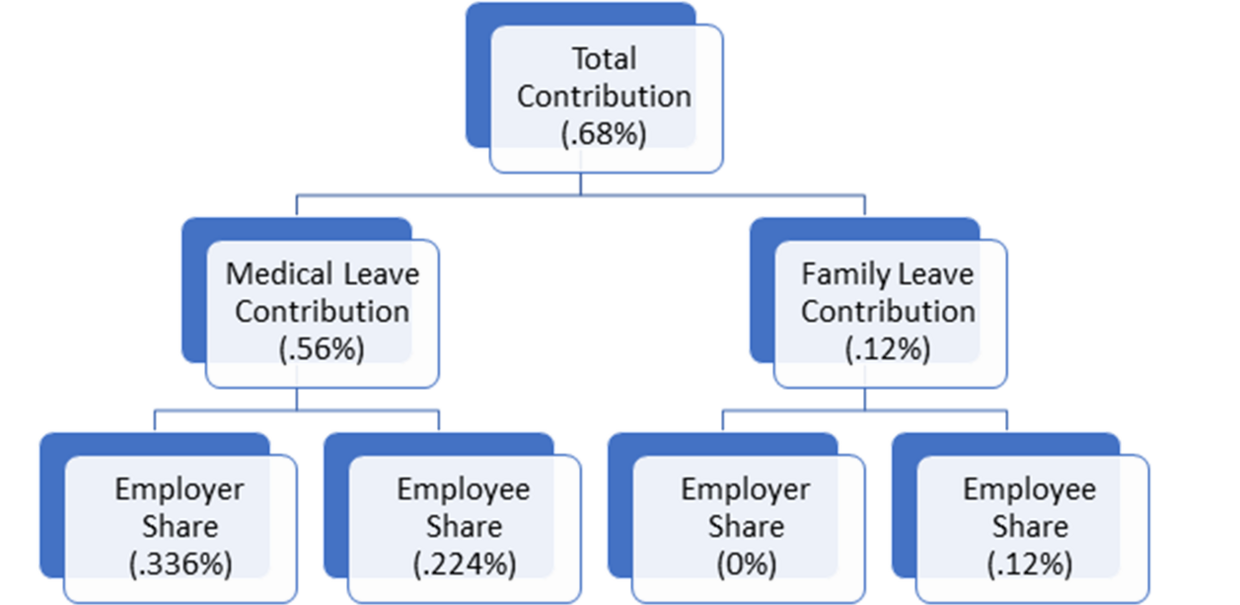

Paid Family And Medical Leave Employer Contribution Rates And Calculator Mass Gov

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

Tax Calculator Estimate Your Income Tax For 2022 Free

Free Tax Preparation Cambridge Economic Opportunity Committee

Paycheck Calculator Take Home Pay Calculator

Massachusetts Sales Tax Rate Rates Calculator Avalara

New York Property Tax Calculator 2020 Empire Center For Public Policy

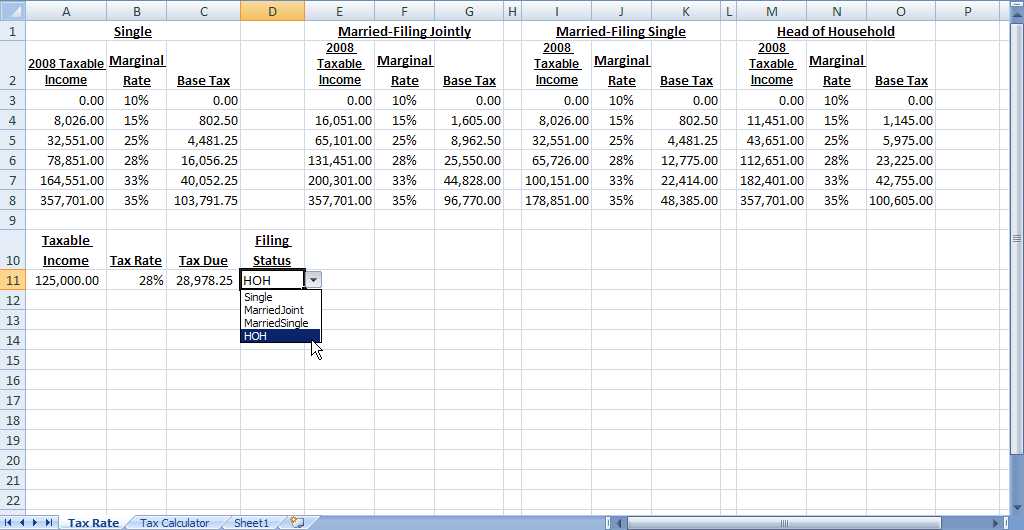

How To Calculate Income Tax In Excel

Build A Dynamic Income Tax Calculator Part 2 Of 2 Davidringstrom Com